Posted: 26/06/2024 | Read time: 4 minutes

We recently hosted a safeguarding workshop for our clients, who heard from industry experts at Protiviti and the AutoRek payments team. In this blog, we summarise the top three insights on what you can expect from new rules.

The FCA will soon publish a safeguarding consultation, which will give payments and e-money firms more detailed, prescriptive guidance on how to safeguard customer funds.

At the moment, information on how to safeguard customer funds is lacking. The only way we’ve seen how the regulation works in practice is when firms have failed.

The consultation, originally set to be published in H1 2024, will likely make the rules more prescriptive. But delays mean the FCA will now likely publish its consultation in the second half of the year.

Based on insights from our latest safeguarding workshop, we’ve set out what the new safeguarding rules might look like – and how you can start preparing for them.

1. Safeguarding will probably look like CASS rules

The FCA has confirmed that “the general direction of travel” will see safeguarding rules look “something a bit more detailed and rules-based like the CASS approach.”

During our workshop, we explored the concept of safeguarding as a ‘close cousin of CASS’. This means the rules are likely to be similar to the rigid rules of the FCA’s Client Asset Sourcebook (CASS), which aim to keep client assets safe in the event of a firm’s failure.

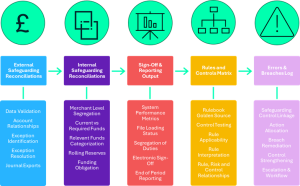

Based on current CASS regulations, here are similar features and requirements that could appear in new safeguarding rules:

- Acknowledgement letters

- Internal and external fund segregation

- Due diligence

- Daily sign-off of safeguarding reports

- Appointment of a dedicated safeguarding officer

As safeguarding becomes more like CASS requirements, payments and e-money firms will need more streamlined operations, a new approach to reconciliations, and investment in tech.

Learn safeguarding best practices and get exclusive insights from the FCA, PwC, fscom, Privat3 Money, and AutoRek. Read the blog here.

2. We can learn from countries with similar safeguarding rules

Safeguarding rules are not exclusive to the UK. A number of geographies have introduced similar rules.

The Bank of Canada put the wheels in motion by launching a consultation in February 2024 on safeguarding end-user funds.

Singapore and Israel are also ahead of the curve. In both jurisdictions, new safeguarding regulations have been introduced, which could be used as a blueprint for UK payments firms.

So, we (along with the regulator) will be keeping a keen eye on how rules in these countries develop and where payments and e-money organisations might be making mistakes.

3. The benefits of an end-to-end automated safeguarding solution

The FCA will likely introduce safeguarding in a phased approach, and firms will have around 12 months to make sure they’re complying with the new regulations.

While firms will have some time to get their processes in order, one thing is clear: it’ll be enormously time-consuming.

Your policy and procedures will need to be in place – robust, tested, and regularly reviewed. And you’ll need to start reconciling your data every day.

Implementing a safeguarding solution can benefit your firm in a number of ways. It helps you:

- Lower the cost associated with meeting safeguarding requirements

- Free up your team and spend more time on value-add tasks by automating the mundane data preparation tasks

- Integrate third-party feeds for complete flexibility in your processes

- Be confident your data is accurate with a secure and reliable data repository

- Improve risk management with configurable dashboards you control from the front end

As safeguarding requirements continue to evolve, staying ahead of regulatory demands is crucial for payments firms. Firms need a robust, efficient back office that meets changing regulatory standards. And they need to know their data is accurate for reconciliation and reporting.

For the past 20+ years, we’ve been supporting the largest asset management & capital market organisation to meet CASS regulations. No customer who has implemented AutoRek has had a regulatory fine in CASS.

Using our experience in CASS, we’ve developed a rules-driven solution that automates key safeguarding processes. So you can meet regulatory requirements while becoming more efficient and reducing your operational costs per transaction.

Learn more about our safeguarding solution here.

For more information on safeguarding, check out our blog: Safeguarding 101: Everything payments & e-money firms need to know.