Posted: 10/04/2025 | Read time: 3 minutes

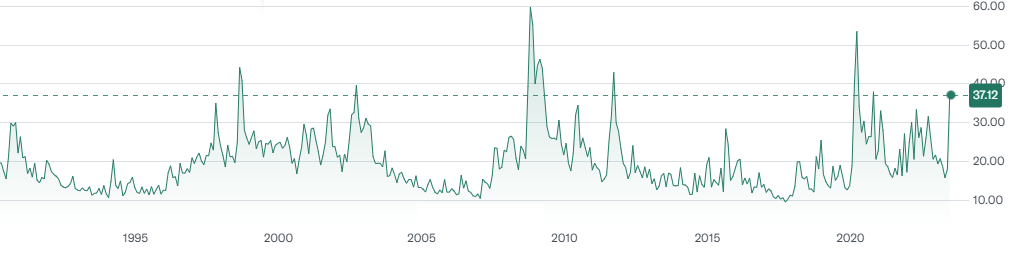

April has witnessed some of the highest levels of market volatility in over a decade, echoing the intensity of the 2008 global financial crisis and the COVID-19 pandemic of 2020.

The VIX Index, often referred to as Wall Street’s “fear gauge,” surged to its third-highest reading since its inception in 1990, a clear indication of widespread uncertainty across capital markets.

Source: Yahoo Finance

This turbulence is largely attributed to a newly imposed U.S. tariff regime, led by President Trump targeting a broad swathe of global imports Tariffs range from 10% on UK goods to as high as 125% on imports from China, raising red flags among global economists. Analysts forecast that these measures could slow growth in the UK and EU, tip North America into recession, and trigger a broader economic downturn in Asia. The anticipated economic impact is being priced into equity positions, prompting significant sell-offs across global equity markets and heightening volatility in options and futures trading. This turbulence has spread into fixed income markets, where selling pressure on U.S. Treasuries has spurred calls for the Federal Reserve to cut interest rates — a move likely to weaken the dollar and fuel FX market volatility. Likewise, now that President Trump has signaled a temporary pause on tariffs for select nations — offering a 90-day reprieve — we’ve seen partial reversals in certain market segments. However, the broader geopolitical and economic uncertainty that initially sparked this volatility remains firmly in place. For trading firms, this level of unpredictability continues to pose both a risk and an opportunity, reinforcing the need for agility and operational readiness.

Source: Yahoo Finance – FTSE 100 Index as of 10/04/2025

Volatility Presents a Strategic Opportunity

Despite macroeconomic fears, firms operating in trading operations — across both buy-side and sell-side — can seize a significant revenue-generation opportunity.

https://www.thebanker.com/content/250b43e2-67e2-46ba-93ea-8a2e2ee49900

In uncertain economic conditions, operational efficiency becomes a key strategic lever. Forward-thinking capital markets firms are prioritising scalable automation to reduce cost per transaction, streamline operations, and increase resilience.

AutoRek is a comprehensive financial data control platform that automates reconciliation, validation, and reporting at scale. Cloud-native and fully SWIFT-compatible, AutoRek is data-agnostic and flexible enough to support complex operational flows across all asset classes. Trusted by some of the largest financial services firms in the world, AutoRek helps firms reduce their average cost per trade, increase capacity, and maintain compliance — even during periods of peak market activity.

For more information, please request a complimentary AutoRek demonstration.