Posted: 10/11/2023 | Read time: 4 minutes

Recent advancements in fintech have transformed the way that many financial organisations conduct their back and middle-office operations. But the insurance industry is one sector that still lags behind.

Although there are signs that firms are adopting AI and advanced analytics to streamline operations, insurers are still beset by back-office inefficiencies. Legacy constraints, multiple core platforms, lack of integration and cobbled-together data flows has left many with limited data control and an overreliance on people rather than technology.

To delve deeper into current trends in and future plans for automation in the insurance industry, AutoRek surveyed 500 insurance executives across the UK and US market.

Here are some of our findings:

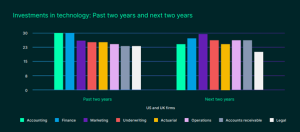

Finance and accounting were key focus areas for the past two years

Finance and accounting dominated as top focus areas over the past two years, with one-third of firms dedicating resources to enhance technology in these areas. It’s likely that increased efforts were made to accommodate requirements for Solvency II and IFRS 17, which would have placed new demands on financial control processes.

Credit control and operations are key focuses looking ahead

Over the next two years, spend on new technology is decreasing in finance and accounting in favour of increased budgets for technology within accounts receivables and operations.

Enhanced investments for accounts receivables suggest that firms are trying to stay on top of debt to ensure profitability and overall efficiency. Respondents clearly recognise the importance of effectively collecting monies owed and ensuring that cash is received rather than written off, especially as we move into a marketplace characterised by growing competition.

Firms are also looking to enhance their operations technology moving forward. In many cases, enhancing back-office operations will be instrumental to eliminating efficiency gaps as the financial sector experiences more pressure on the bottom line.

Budgets for automation on the rise

The impact of COVID-19 forced many businesses to invest heavily in transformation and automation initiatives. Results detailed in this graph show that insurance organisations are set to continue this trend in 2024.

All firms plan to increase their budget by at least if not greater than the rate of inflation. It is reassuring to see no regression in automation investments, which indicates that the industry has one eye on cost-reduction looking ahead.

Brokers are elevating their budgets more aggressively than other sub-sectors. This shouldn’t come as a surprise, given their intermediary position in the industry requires them to deal with and drill down into large volumes of data. Higher levels of automation in the broking sector also offer process simplification for those with offshored processes or complexities that have arisen from M&A activity.

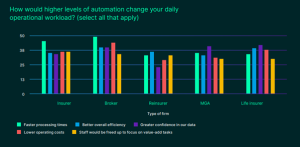

Automation budgets are targeting faster processing times

Four in ten we surveyed pointed to faster processing times as the top benefit realised by operational automation. Responses here are consistent with our work across the financial sector, where a growing number of organisations are replacing repetitive manual work with 24-hour automation.

Faster processing times should bring much-needed efficiency to an insurance industry that frequently deals with large volumes of data in multiple formats. With faster processing times, firms can also handle increased data volumes without a corresponding rise in headcount.

Drivers behind automation differ across sub-sectors

Insurers and brokers – i.e., the most customer-facing firms – value faster processing times more highly than their counterparts, but other sub-sectors are pushing for automation to address different challenges.

MGAs and life insurers report that automation would benefit them most by bringing greater data confidence. This is to be expected, considering these sub-sectors tend to struggle with data quality. Firms should look for a tool with automated data validation checks for maximum efficiency.

Around one-third of firms are leveraging automation to free up staff from manual data work. Doing so would allow staff to focus on value-add tasks rather than laborious spreadsheet-based processes – something which is especially critical given how difficult it is to find and attract skilled financial workers.

To learn all of the insights from our insurance survey, read the full report here.